One college-educated middle-class family, with stable employment for 30-40 working years, health benefits, and financial literacy, saves $300 a month diligently for retirement. Over 40 years, and through compounding interest, this becomes over $1 million. Used wisely, this family will leave their children more money than what they started with at their retirement party – let me stress this point: not only will their money not run out, but it will continue to grow as time passes. Overwhelmingly, it is the white families that have historically been able to achieve these financial goals contributing to making the racial wealth gap in the USA so vast.

I must admit that it was very recently that I had this realization. I knew saving for retirement was very important for my own well-being in my golden years. However, it never dawned on me that this was also the best tool to leave a legacy of safety for the next generation- we are quite literally assembling the path our children and grandchildren will walk.

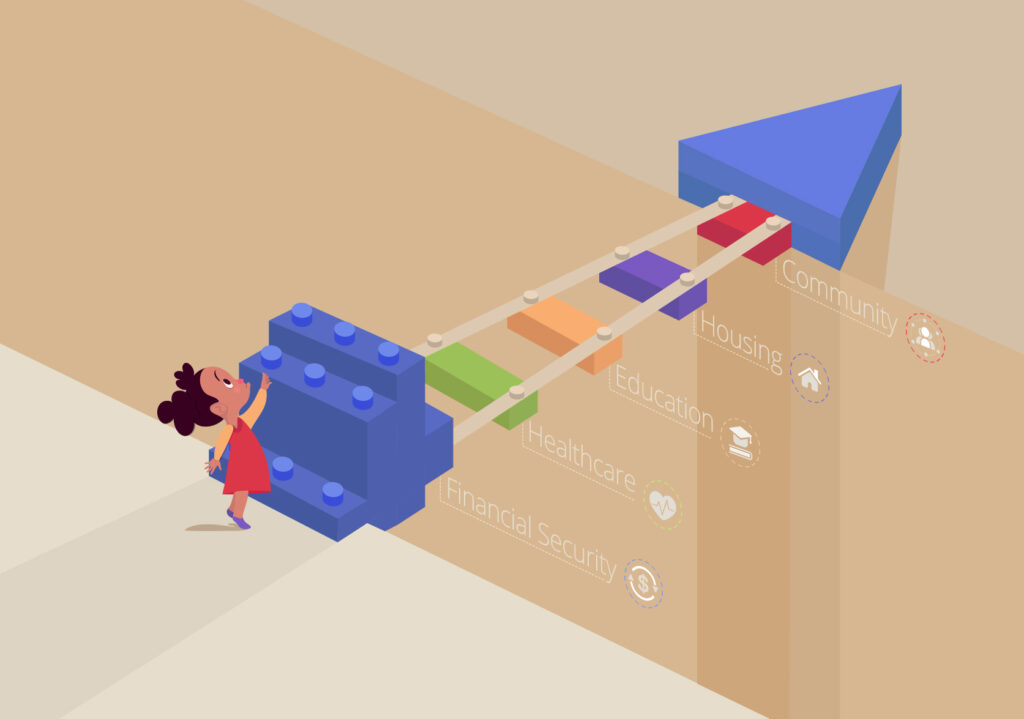

Today’s racial wealth gap is the consequence of systemic exclusion from educational, economic, and financial systems that compound with every passing generation. The social determinants of wealth such as housing, education, and healthcare are not equally and equitably benefiting everyone. This inequality is the heart of the matter.

While the wealth of white families continues to grow over time, costs have skyrocketed since the 1960s without wages keeping pace, especially within communities of color.

(All numbers are adjusted for inflation)

- Home prices have increased 121%

- The cost of an undergraduate degree rose by 143%

- The cost of health insurance has increased 78%

In the 1970s, housing, education, and health care took 50% of household income; in the 2000s, they accounted for 75% of household income. Communities of color have historically and continue to be the lowest percentiles of these statistics. The result is the inability for parents to construct enough of a safety net to provide an advantage for their children. An advantage that white children benefit from to a much greater extent.

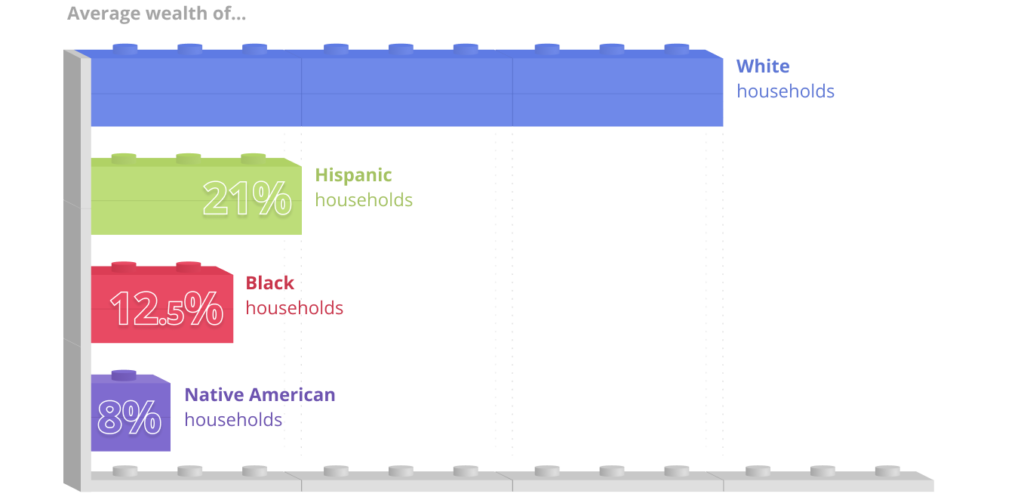

Gaps in Generational Wealth

Gaps in wealth are shocking between white and BIPOC families, and the gap is getting wider in many cases. In 2019:

White households are also more likely to own homes and retirement assets and have higher values in those assets. These gaps persist even when comparing wealth between households with similar education levels.These disparities have existed for generations due to policies and practices such as exclusion from building wealth via the Homestead Act, the Social Security Act of 1935 and the G.I. Bill of 1944; and redlining practices. Since 1776, 1.5 billion acres of land have also been taken from Native Americans, taking much of their source of generational wealth. All this has put other races generations behind Whites in accumulating generational wealth – each generation of color is essentially starting from scratch.

I invite you to consider the following and ask yourself “What if?

If being able to build generational wealth can reverse this trend in as little as one generation, why isn’t it being done? At the beginning of this article, we mentioned that an individual nuclear family could retire with over 1 million dollars, live well, and still have more to leave their children. Given the current economic challenges, how is it even possible to retire with 1 million dollars though? We can solve this if only we put our will and pressure in the right places – the structures of oppression in place are not immovable. We live in incredibly transformational times where we are redefining the role that work, family, social justice, and politics play in our lives. Why not look at what organizations and organizational leaders can do NOW?

What if companies…

- Automatically open and contribute to employee’s retirement funds without the employee having to contribute? This will allow those living paycheck to paycheck to benefit from compounding interest even if they aren’t able to afford retirement contributions.

- Provide higher percentage bonuses to those in lower salary grades? Today it is the other way around, and incentive compensation benefits those with high enough salaries to arguably not need the bonuses.

- Help employees start college savings retirement accounts for their children upon their birth. Better yet, open them and contribute to them.

- Provide financial coaching and planning to their employees as a standard benefit. Why not make it a compliance requirement to have a session with a financial counselor?

- Prioritize recruitment from underserved areas or public universities to reduce geographic barriers to career advancement.

What if societal and government programs…

- Removed the requirement for earned income for individuals under the age of 18 so that parents can begin contributing to retirement accounts for their kids at birth? Even better, employers can contribute a nominal amount to these accounts for the child to benefit from compounding. $100 a month over 60 years becomes 1.8M assuming an 8% rate of return. Read the last sentence again.

- Provided those most impacted by racial, economic policies college savings funds, partial loan forgiveness, and deposits into a retirement account.

- Health insurance companies started a college savings fund for new parents upon the birth of their child with a small initial contribution.

- Created tax deductions for families to start retirement funds for kids at five years of age?

- Lowered the tax liability of lower-income families, so they have more to invest?

- Cut the tie between healthcare and jobs since losing jobs means losing health care when you need it most?

We need to think of bold solutions and be brave enough to experiment with them. This is a problem that can, and should, be addressed now to set the next generation up for success.

What bold and out-of-the-box ideas do you have?